News

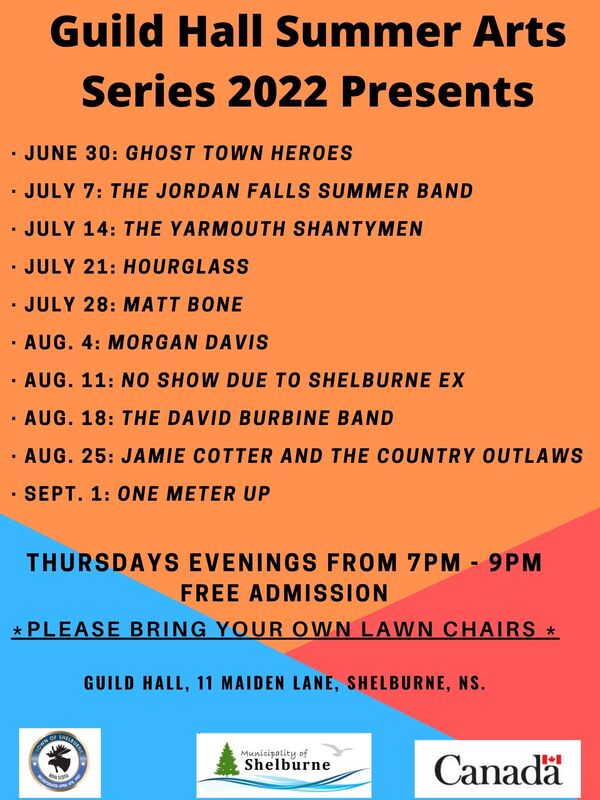

Guild Hall Summer Arts Series 2022

- Details

- Published: Monday, 11 July 2022 09:45

Expression of Interest- PID#s- 80149412, 80149420 and 801494378

- Details

- Published: Tuesday, 28 June 2022 16:15

INVITATION TO SUBMIT AN EXPRESSION OF INTEREST (EOI) FOR THE PURCHASE OF PIDs 80149412, 80149420 and 801494378 IN THE TOWN OF SHELBURNE, NOVA SCOTIA

29 JUNE 2022 FILE NUMBER 2023-9412/9420/9438

Following the requirements of the Council Disposal of Surplus Property Policy of 2019 (Policy), the Town of Shelburne (Town) is moving forward with disposing of surplus property in a fair, legally compliant and impartial manner, which takes into account the highest financial return to the Town, balanced with economic and community development opportunities. The Town has determined it has not identified any long-term use for this property (see Policy 1.a) ).

Through this Call for Expression of Interest method (see Policy 3.a) ) the Town is asking interested parties to submit sealed submissions for the purchase of the properties of PIDs 80149412, 80149420 and 80149438 altogether (as a parcel) plus the unopened 60-foot wide roads in-between (see map below). The Town requires the parcel to be utilized for housing development with a minimum of 12 units, for the approximate 5.28-acres of land. Per the Land Use By-Law, this parcel is presently zoned Residential Mobile (R-M) therefore purchaser would have to apply for any desired zoning changes, per Section 210 of the Municipal Government Act of Nova Scotia (MGA).

The parcel will be awarded to the highest bidder and requires the purchaser to sign a buy-back contract, agree to submit their plans to the Town for housing development within 120 days of signing as well as complete the building of said development within 36 months of signing. The minimum bid is set at $49,000. Applicable taxes and transfer fees will be additional costs and at the expense of the purchaser. The Town will cover the cost of the survey but not the migration (registry) or rezoning (if requested). The unopened Morris Street on the north side of a portion of this parcel may be made available for purchase by any abutting property owners, at a future date.

Section A: Responses

Interested parties are requested to submit their responses to this EOI in writing to the following address:

Town of Shelburne

Attention: Office of the CAO

168 Water Street, PO Box 670

Shelburne, NS

B0T 1W0

Please indicate File No. 2023-9412/9420/9438 on all correspondence.

Section B: Responses Requested by

As this may be the only invitation to submit an Expression of Interest to purchase this property, interested parties need to provide responses by noon AT, July 22, 2022. Any response received after this date will not be considered.

Section C: Security Deposit and Remaining Payment

Submissions require a minimum payment of five thousand ($5,000) dollars and if you are the successful bidder, the remaining payment is due within twenty (20) business days. If not received within that timeline, the next highest bidder will be awarded the property and will be allotted 20 business days to submit the remaining payment.

Section D: Additional Information

For more information, please contact Sherry Doane, CAO, by phone at (902) 875-2991 x5 or by email to: sherry.doane@shelburnens.ca

Note that this is a Call for Expression of Interest. The Town will not necessarily post any future ads related to this request.

Friendly Reminder

- Details

- Published: Monday, 27 June 2022 14:40

Please note our By-Laws can be found on the website here:

Street Closure-June 22

- Details

- Published: Wednesday, 22 June 2022 10:27